Customization of accounting coding defaults of crew payroll has never been easier!

How to: Customize Default Employee Position Coding When Sending an Offer

How to: Edit Default Employee Position Coding For Existing Employees

Employee Coding Template

General Payroll Accounting Codes Information

How to: Customize Default Employee Position Coding When Sending an Offer

Step 1: On a Digital Start Form, scroll down to the Account Codes panel

Step 2: The only required field in the Coding Grid is the Labor Account Code. Additionally, default accounting codes can be used in great detail. See below for further instructions.

Step 3: Submit the Start Form

How to: Edit Default Employee Position Coding

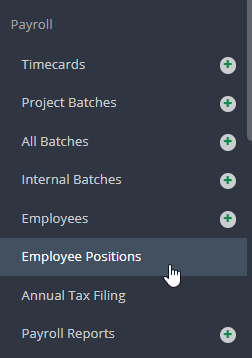

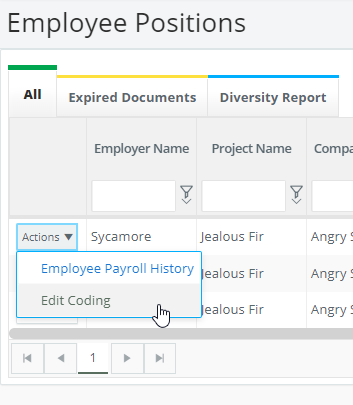

Step 1: Click EMPLOYEE POSITIONS.

Step 2: Click Actions and Edit Coding

Step 3: Update your coding defaults and click SAVE.

Note: You may filter by coding defaults for labor, other earnings, and fringes. The Custom Grid Views at the top are designed to show you just the right amount of information that matches your needs. To learn more about custom grid views, please click here.

Employee Coding Template

General Payroll Accounting Codes Information

With the exception of the “Holiday Accrual” and “Vacation Accrual”, each Expense Type Group is broken down into the following rows:

- 1st row: Expenses - Codes added on this row will show on the Digital Timecard.

For example, to preset Timecard coding for a box rental, add a code in the first row of the Box Rental Expense Type group. - 2nd row: Generic Fringes. The account code of all fringes, when not specified otherwise.

Note: If labor fringe is defined and unique fringe coding per Expense Type Group is not defined, coding of fringes from the respective group will match the fringe account coding of the labor line. - 3rd through 6th rows: “Fringe Breakout”

-

- Worker’s Compensation

- State Tax

- Federal Tax

- Payroll Fee

- Pension & Welfare

-

The Fringe row and Fringe Breakout rows are used to code items that don’t appear on Digital Timecards but are visible on Payroll Reports or when Posting Payroll.

The “Generic Fringe” row is used to code all fringes unless a code has been provided on a “Fringe Breakout” row. Example:

Fringe associations to Expense Type groups are managed by GreenSlate and apply to all projects.

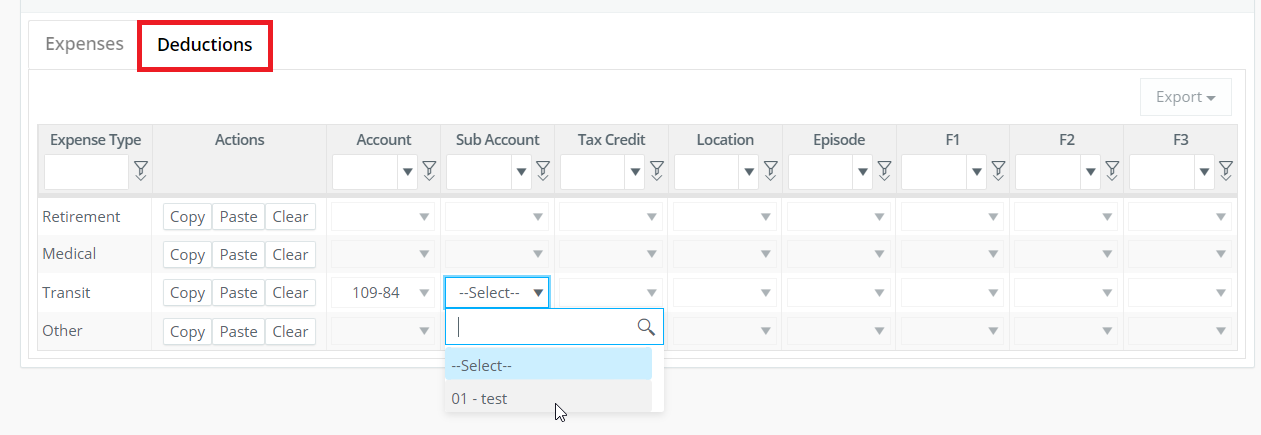

Deductions

Coding defaults for some deductions may also be added. Deductions are located on the “Deductions” tab of the Account Codes panel, and default accounting codes may be defined for Retirement, Medical, Transit, and Other.

Expense Type Group Associations

For a code to appear when a Day Type or Other Earning is added to a timecard, the code must be preset on a specific row of the grid.

Associations follow logical rules, allowing users to fill out the grid instinctively.

Here are some of the most commonly used pay items and their associated expense type:

|

Pay Items |

Expense Type Group |

Grid view |

|

Day Types |

||

|

Work |

Labor |

Basics |

|

Idle |

Labor |

Basics |

|

Travel |

Labor |

Basics |

|

Covid Sick |

Labor |

Basics |

|

Holiday |

Holiday Payout |

Advanced |

|

Vacation |

Vacation Accrual |

Advanced |

|

Other Earnings |

||

|

Box Rental |

Box Rental |

Basics |

|

Cell Phone |

Cell Phone |

Basics |

|

Meal Allowance |

Meal Allowance |

Basics |

|

Mileage |

Mileage |

Basics |

|

Car Allowance |

Car Rental |

Advanced |

|

Covid Stipend |

Labor |

Basics |

|

Hazard Pay |

Labor |

Basics |

Filtering

The Custom Grid Views at the top are designed to show you just the right amount of information that matches your needs.

The Expense Type filter can be used to show a specific fringe type across all Expense Type groups.